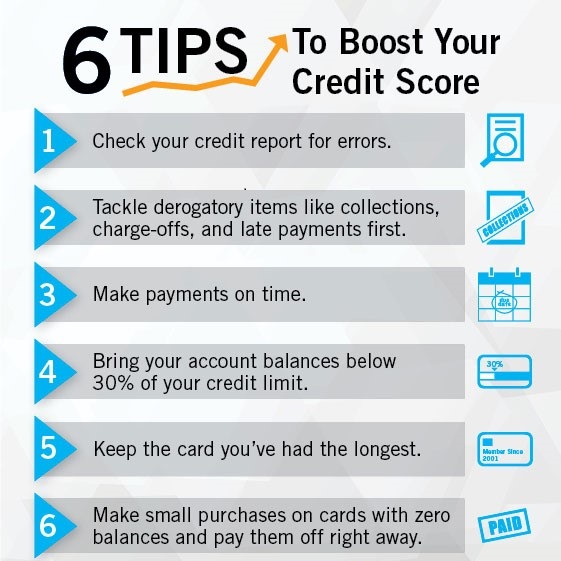

6 Tips to Boost Your Credit Score

Your credit score is one measure of your financial health and whether you’re responsibly managing your money. Lenders often use this information to assess your reliability as a borrower—whether you pay back your loans regularly and on time.

But many of us have experienced setbacks in life that may impact our credit scores negatively. Mounting debt, late payments, accounts in collections—these are just a few things that can hurt your score and jeopardize your ability to borrow or qualify for low interest rates on loans, open a checking account, or rent an apartment.

But just like many things in life, there are always opportunities to bounce back. Rest assured that you can repair your credit! It may be a slow process, but with determination and discipline—and perhaps a little help from a Cal Coast Budgeting and Financial Fitness Coach—you can get your score healthy again.

A good place to start: these 6 Tips to Boost Your Credit Score! Read on below.

1. Check your credit report for errors

Everyone is entitled to a free copy of their annual credit report from each credit reporting bureau. Visit annualcreditreport.com and request your report, then review it to ensure that the information on there is accurate and pertains to you.

According to the Consumer Finance Protection Bureau, some of the most common errors found in credit reports include:

- Accounts belonging to another person with a similar name

- Closed accounts being reported as open

- Accounts with incorrect balances

- Accounts created as a result of identity theft

Found an error on your report? File a dispute with the credit bureau that has the incorrect information. Make sure to check the other two credit bureaus as well.

2. Tackle derogatory items like accounts in collections, charge-offs, and late payments first

Once you’ve received your credit report and verified that the information on it is accurate, the next thing is to fix the items that have the highest negative impact on your score.

Derogatory items like accounts in collections, charge-offs, and late payments are good starting points. If you have unpaid accounts that are delinquent, pay them off or settle them as soon as you can.

Keep in mind: Settled items have a less negative effect than unsettled items, and paid items have a more positive effect than settled items.

3. Make payments on time

Payment history makes up 35% of your credit score, so it’s important to stay on top of those due dates for credit card and utility bills. If you can, set up automatic billing so you never miss a due date.

You don’t have to pay off the balance in full every time (although it is recommended), but make sure you pay at least the minimum payment amount by the due date.

Your score prioritizes payment history from the last 2 years, so recent payments have the most impact. Remember: It’s important to make a habit of paying your bills on time as this contributes the most to your overall credit score.

4. Bring your account balances below 30% of your credit limit

A good rule of thumb is to avoid spending more than you earn. When you live outside your means, you can rack up debt that can quickly snowball out of control. The amount of debt you have makes up 30% of your credit score, so stay alert!

If you’ve accumulated high debt on your credit cards, try to get your balances below 30% of your credit limit. So if your credit card limit is $1,000, make sure that you’re keeping your spending under $300 on that card.

If you must use your credit card for a high ticket item, either pay it off in full next month or pay the minimum required to bring the balance under that 30% threshold.

Each card that has a balance over 30% of the credit limit can mean a 15-30 point difference in your credit score, so make sure to keep track of your balances!

5. Keep the card you’ve had the longest

The length of your credit history—meaning how long you’ve had your oldest line of credit—makes up 15% of your credit score. The longer you’ve had a positive payment history, the better your score.

But what if you’re just starting out? It’s important to build your credit by making payments on time and keeping those balances below 30% as mentioned earlier.

One mistake some folks make is closing out credit cards after they’ve paid them off. This can negatively impact your score because you’re not only reducing the total amount of credit available to you, but you may also be closing out a card that you have a long payment history with, thus bringing down your score.

6. Make small purchases on cards with zero balances, then pay them off right away

Another misconception some people have is that paying off a credit card and simply not using it is a good practice. Not so! Paying off your balances is always a best practice, but you also have to demonstrate that you’re using your credit. Lenders want to see responsible spending, not necessarily zero spending!

Once you’ve paid off a credit card, make a small purchase on it. Then pay it off immediately. It doesn’t have to be a big purchase. Whether it’s a pack of gum or a tank of gas—the amount doesn’t matter, just so long as you show you’re using your card and paying it off on time.

So that’s our 6 tips to boost your credit score. As always, Cal Coast is here to help you on your path to financial wellness. Our Budgeting and Financial Fitness Coaches are available to answer member questions at no cost, so be sure to take advantage of this benefit. Schedule your appointment today!

We also host free educational workshops on a variety of financial topics.